Getting your home ready to sell can feel like a circus act. Without the right organization, juggling the countless moving parts involved in this stage of the selling process can take its toll. This is the perfect opportunity to create a checklist to keep yourself on track and within your budget. The following information will illuminate the key responsibilities you face as a homeowner as you prepare to hit the market.

We’ve included a comprehensive checklist below of the common tasks required to get your home ready to sell. It is also available as an interactive web page and downloadable pdf here: Get Ready to Sell Checklist

Preparing to Sell Your Home: Working with an Agent

Before you start working on the house itself, it’s best to get the ball rolling on the strategic aspects of selling a home. Working with a real estate agent is the best way to get your home sold for the best price in a timely manner.

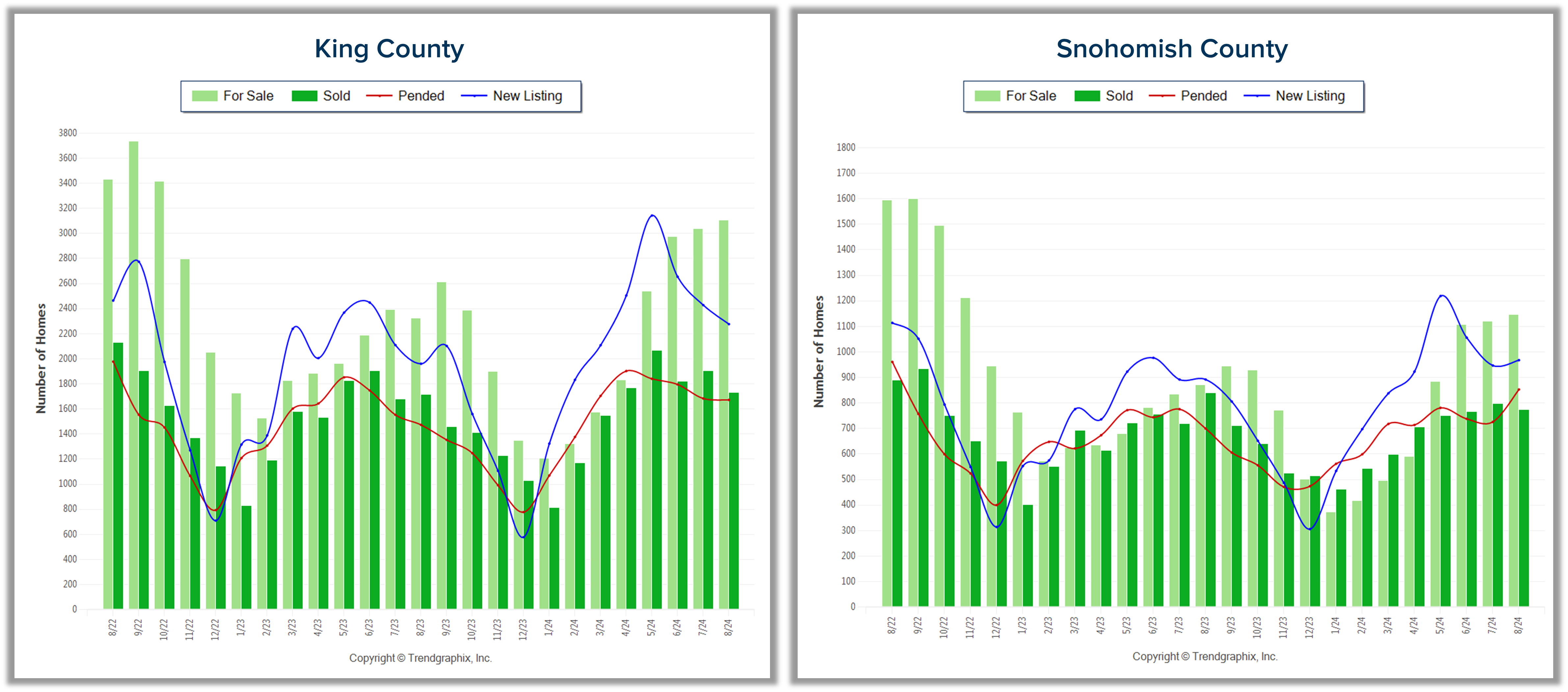

A listing agent will represent you throughout the selling process to determine the value of your home, coordinate open houses, market the property, and negotiate with buyers to reach a deal. In the early stages of your discussions with your agent, they will conduct a Comparative Market Analysis (CMA) to see what price your home could fetch on the market, accounting for various factors that influence home prices such as seasonality and local market conditions. Based on the findings of your agent’s CMA, you can discuss whether remodeling fits into your go-to-market strategy, and your agent can provide intel on which remodeling projects could deliver significant ROI based on buying trends, your location, and what comparable listings in your market are offering.

Home value estimation tools can help you get an idea of what your home is worth to facilitate your conversations with your agent. Use our free Home Worth Calculator by clicking the button below:

Image Source: Getty Images – Image Credit: FG Trade

Preparing to Sell Your Home: A Complete Checklist

Once you’ve found an agent, you’re ready to get your home in tip-top selling shape. The following checklist is available as a free downloadable PDF here:

Get Ready to Sell Checklist – PDF

Exterior

This list of value-adding curb appeal projects will help to form buyers’ first impressions of your home and make your ever-important exterior listing photos stand out amongst the competition.

- Remove peeling and chipped paint; replace with a fresh coat

- Fix loose trim and fencing

- Clear gutters and downspouts

- Make sure there is good exterior lighting and all walkway lights and front-door lanterns work

- Clean and repair the roof as needed

- Clear garage of clutter and tidy shelves

- Inspect chimney for cracks and damage

Yard

- Mow and trim grass; re-seed and fertilize where necessary

- Prune all overgrown trees and shrubs

- Weed flowers beds

- Remove or replace dead or diseased plants, shrubs, and trees

- Clean grease and oil stains from driveway

Decks/Patios

- Paint or stain worn areas on wood decks

- Remove grass growing in concrete cracks; sweep off debris from shrubs and trees

- Clean all deck rails and make sure they’re secure; replace missing slats or posts

- Clean outdoor furniture

Front Door

- Polish or stain worn areas on wood decks

- Add a fresh coat of paint to get rid of nicks

- Clean the glass on the storm door; make certain the screen is secure

- Make sure the doorbell operates properly and there are no squeaks when the door opens and closes

Windows

- Clean all windows inside and out

- If needed, add a fresh coat of paint to the window trims and sills

- Make sure all windows open and close easily

- Replace cracked windowpanes and those with broken seals

- Make sure window screens are clean and secure; replace any screens with holes or tears

Front Entry

- Clean entryway floors and area rugs

- Downsize clutter in the entry and entry closet to give the appearance of spaciousness

- Double-check entry lighting to make sure it works

Interior

Not only will these interior projects get your house sparkling clean, but they’re also preparatory steps for staging your home and hosting open houses.

General Interior Cleaning

- Clean all floors, carpets, walls, and trim

- Replace burned-out light bulbs

- Empty trash

- Remove family photos, valuables, and prescription drugs

- Tidy up clutter

Kitchen

- Fix dripping faucets

- Organize pantry and cupboards so they appear clean, neat, and spacious

- Make sure the refrigerator and freezer are defrosted and free of odors

- Clean the oven and cook top thoroughly

- Set the table

Living/Family/Dining Rooms

- Give rooms a fresh coat of paint as needed

- Repair cracks and holes in ceiling and walls

- Make sure all wallpaper is secure

- Repaint any woodwork that is worn or chipped

- Clean or replace draperies and blinds; open them to maximize light

- Make sure draperies and blinds open and close

- Steam-clean carpets

- Clean rugs and wood flooring, and remove any stains or odors

- Position the furniture to showcase the size and space of the room

- Remove and replace any attached items, such as chandeliers and draperies, that you wish to move with you

- Put away toys and hobby supplies; remove extra magazines and books from tables

Bathrooms

- Make sure sinks, tubs, showers, and countertops are clean and free of stains

- Repair any leaky faucets

- Remove grout and soap stains from tile

- Replace any missing or cracked tiles or grout

- Make sure all joints are caulked

- Make sure all fixtures, including heat lamps and exhaust fans are operating

- Install a new shower curtain and buy matching towels

- Store all supplies, such as toilet paper, shampoo bottles and cleansers, out of sight

Bedrooms

- Repair cracks in ceiling and walls

- Apply a fresh coat of paint if necessary

- Make sure all wallpaper is secure

- Clean draperies and blinds; open them to maximize light

- Put away toys, clothes, and clutter

- Neatly make up the beds

Basement

- Check for water penetration or dampness; call for professional repairs if necessary

- Get rid of musty odors

- Clean furnace, hot water heater, and drains

- Make sure light fixtures work

- Arrange storage area in a neat and organized manner

- Make sure stairway handrail is secure

Tidy Extras

- Use air fresheners or bake treats to make the house smell good

- Plant flowers to brighten the walkway and enrich the entry

- Remove any indoor houseplants that are brown or losing their leaves

- Remove all “fixer” cars, campers, and boats from the property

- Discard the clutter of magazines on the coffee and end tables

- Tidy and declutter all closets

- Hide or get rid of worn-out throw pillows

- Store pet supplies

- At night, turn on the porch light and outdoor lighting

- Put away toys and hobby supplies; remove extra magazines and books from tables